New research highlighted in today’s OneRoof Property Report shows housing affordability nationwide has taken a significant hit, with an explosion in the number of $1 million suburbs across seven of New Zealand’s major metro areas.

The research, carried out by OneRoof and its data partner Valocity, analysed house price inflation across 646 suburbs in Auckland, Christchurch, Dunedin, Hamilton, Queenstown, Tauranga and Wellington.

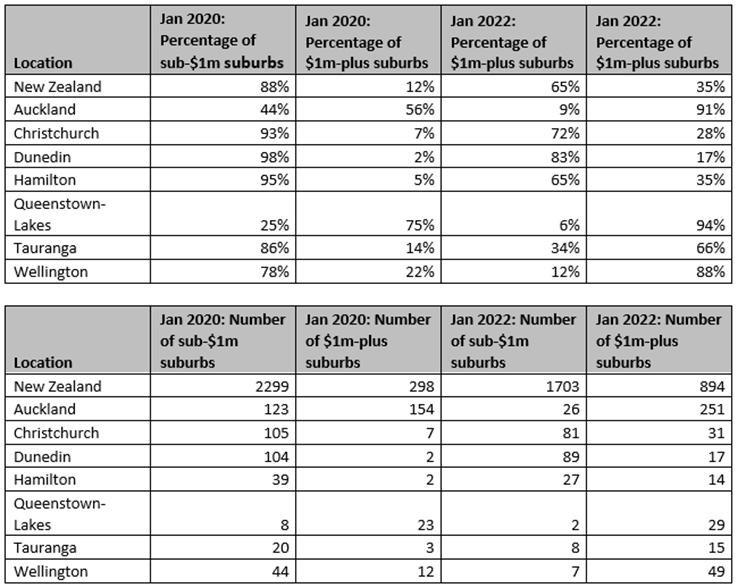

Between January 2020 and January 2022, the number of $1 million plus suburbs across the major metros had grown 100 percent from 203 to 406. Outside of those metro areas, the number of $1 million plus suburbs grew 413 percent from 95 to 488 over the same period.

Furthermore, the nationwide average property value jumped 45 percent from $760,000 to $1.103m, with some cities seeing house price growth of more than 50 percent.

OneRoof editor Owen Vaughan says the research clearly highlights the growing inequality in New Zealand’s housing market.

“The housing market boom has irrevocably changed the face of New Zealand’s biggest cities, turning previously affordable suburbs into no-go areas for first home buyers. The housing frenzy of last two years, fuelled by low interest rates and FOMO, has radically altered the landscape for buyers and sellers.

“Not only have we seen an explosion in the number of $1 million plus suburbs nationwide, but there’s also a significant crunch at the bottom end of the market. Across the metros we analysed, the number of suburbs with an average property value of less than $500,000 decreased 82 percent, from 84 suburbs to just 15.

“Suburbs that have a property value of less than half a million across New Zealand’s major cities are also now few and far between, with the majority of those suburbs being in fringe locations with very few amenities or services,” says Vaughan.

The research showed the region most affected was Wellington, where the suburbs with an average property value of less than $1 million fell by 85 percent - from 44 suburbs in January 2020 to just seven in January 2022.

Tauranga saw the next biggest fall in sub $1 million suburbs - a 60 percent decrease from 20 suburbs to 8 suburbs over the two-year period.

Auckland fell from 123 suburbs under the $1 million mark to 26 over the same period, while the number of suburbs in the $1.5 million plus band increased by a whopping 161 percent from 57 to 149.

Vaughan says of real concern was the change in house prices in South Auckland, with the cheapest suburb in the region now having an average property value of $738,000 and most suburbs closing in on $1 million.

“In January 2020 there were ten South Auckland suburbs with an average property value of less than $700,000. Now there are none. In a region where incomes are lower and housing stock is typically of lower grade, this trend is worrying and further demonstrates the impact the housing market boom has had, making home ownership even further out of reach for many New Zealanders,” he says.

ENDS

For further information please contact:

Kelly Gunn

GM Communications – NZME

+64 27 213 5625